Analysis of Wednesday's deals:

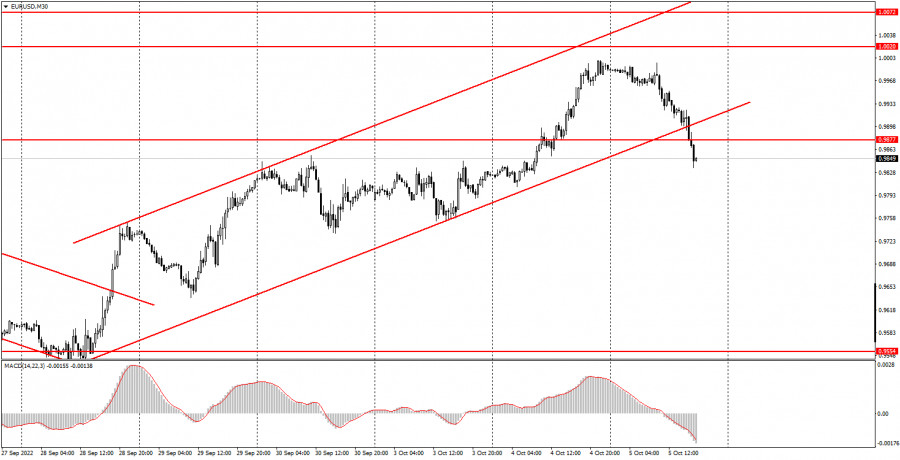

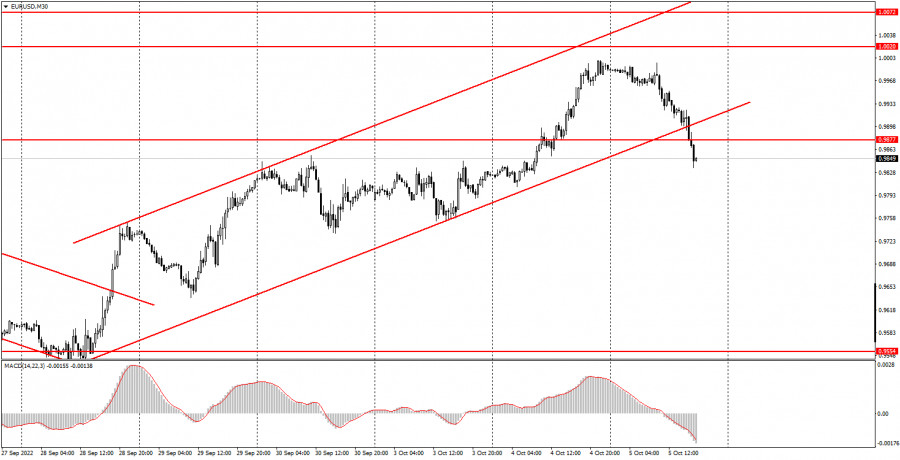

30M chart of the EUR/USD pair

The EUR/USD currency pair plunged sharply and unexpectedly on Wednesday. At the moment, the euro lost about 130 points, which is a lot. It should be noted that several interesting macroeconomic reports were published in the morning and during the day. In the European Union, there was another decrease in the index of business activity in the services sector, the index is below 50.0. In the US, the increase in the number of employees in the private sector, according to the ADP report, amounted to 208,000, which is higher than the value of the previous month and forecasts. Also, indexes of business activity in the services S&P and ISM just came out, which showed either a fairly strong growth or no change. Thus, the macroeconomic background on Wednesday could contribute to the strengthening of the US dollar. The question now is, do we now see the beginning of a new global upward trend for the euro, or will everything, as usual, end with mediocre corrections? This will largely depend on Friday's report on Nonfarm and geopolitics. Unfortunately, geopolitics continues to worsen more and more every day, and the pair on the hourly chart has already consolidated below the rising channel. Thus, we believe that the euro's fall in the remaining days of the week is very likely.

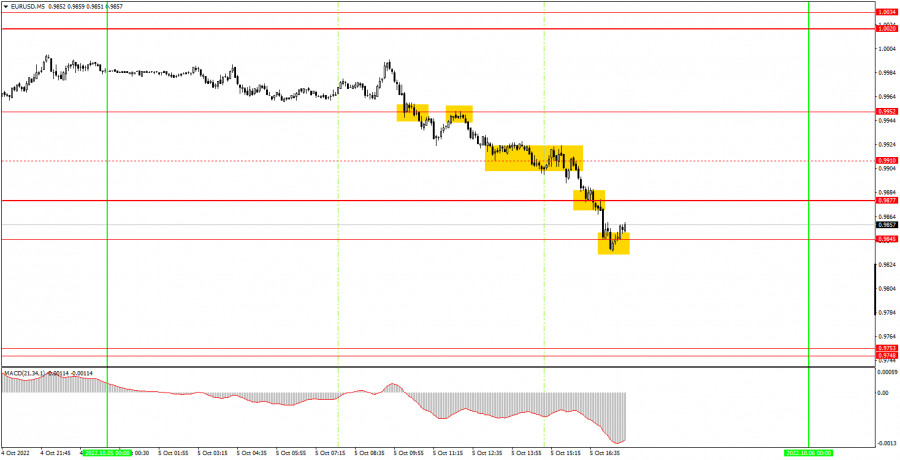

5M chart of the EUR/USD pair

There were enough trading signals on the 5-minute timeframe. At the very beginning of the day, a sell signal was formed near the level of 0.9952, which was duplicated literally an hour later. Novice players had to open a short position. For almost the entire day, the pair only fell. It overcame the levels of 0.9910, 0.9877 and stopped only near the level of 0.9845, where the short position should have been closed. Profit on it amounted, therefore, to at least 80 points. At the end of the day, the level of 0.9910 was recognized as no longer relevant and removed from the charts. Wednesday turned out to be very successful: one trade transaction - profit.

How to trade on Thursday:

The pair left the ascending channel on the 30-minute timeframe, having spent about a week in it. Thus, on Thursday and Friday we can observe the downward movement of the pair. Recall that almost any geopolitical news can provoke a new growth of the dollar. An important NonFarm Payrolls report will be published on Friday, which can affect the pair's movement in any direction. On the 5-minute TF on Thursday it is recommended to trade at the levels of 0.9636, 0.9748-0.9753, 0.9845, 0.9877, 0.9952, 1.0020-1.0034, 1.0072. When passing 15 points in the right direction, you should set Stop Loss to breakeven. The EU will publish a report on retail sales for August, and in the US - a report on applications for unemployment benefits. Both of these reports are frankly secondary, so one should not expect a strong reaction to them. Beginners should pay more attention to technical analysis.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the US one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.